Has BHP and WOW survived the reporting season snow storm?

The final reporting season avalanche has coincided with a serious amount of snow in the high plains. No matter where one turns, there’s no escaping heavy falls. More than 300 companies have reported in five days and I am completely snowed under. If you haven’t yet received my reply to your email, now you understand why.

The final reporting season avalanche has coincided with a serious amount of snow in the high plains. No matter where one turns, there’s no escaping heavy falls. More than 300 companies have reported in five days and I am completely snowed under. If you haven’t yet received my reply to your email, now you understand why.

To put my week into perspective, up until last Monday morning, around 200 companies had reported (see my Part I and Part II reporting season posts). This week’s 300-company avalanche brought the total to 500. I’m sorry to report that without a snowplough, I have fallen behind somewhat. Around 200 are left in my in-tray to dig through. I will get to them!

Thankfully, there are only a few days left in the window provided by ASX listing Rule 4.3B in which companies with a June 30 balance date must report, and by this afternoon, I will be able to appreciate the backlog I have to work through. So not long to go now…

Nonetheless, today I would like to talk about two companies which I am sure many of you are interested in: BHP and Woolworths. Both received the ‘Montgomery’ B1 quality score this year.

For the full year, BHP reported a net profit of around A$14b and a 27% ROE – a big jump on last years $7b result, which was impacted by material write-offs. Backing out the write-offs, last years A$16b profit and ROE of 36% was a better result than this years. The fall in the business’s profitability has likewise seen my 2010 valuation fall from $34-$38 to around $26-$30 per share, or a total value of $145b to $167b (5.57 billion shares on issue).

With the shares trading in a range of $35.58 to $44.93 ($198b to $250b) for the entire 52 weeks, it appears that the market and analysts expected much better things. While they didn’t come this year, are they just around the corner? I will let you be the judge.

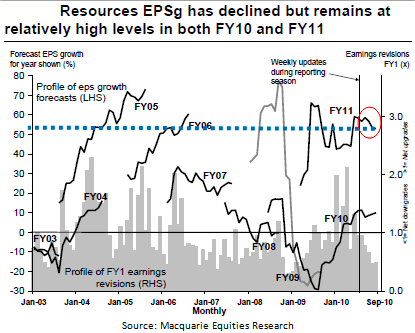

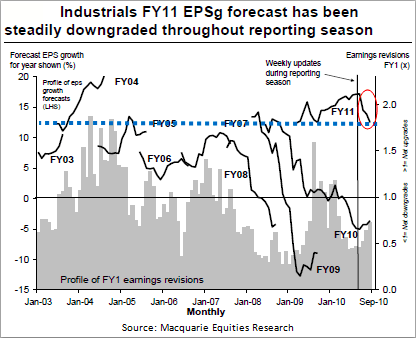

The “market” (don’t ask who THAT is!) estimates resource company per share earnings growth of 50 per cent for 2011. I have drawn a thick blue line to show this on the left hand side of the following graph so you can see where my line intersects.

BHP has a large weighting in the resources sector, so the forecast increase in net earnings by 57 per cent to A$22b is having a material impact on the sector average. Importantly, the forecast growth rate is similar to those seen in 2005 and 2006 when the global economy was partying like there was no GFC. Call me conservative, but I reckon those estimates are a little optimistic in todays environment.

As you know I leave the forecasting of the economy and arguably puerile understandings of cause-and-effect relationships to those whose ability is far exceeded by their hubris. Its worth instead thinking about what BHP has itself stated; “BHP Billiton remains cautious on the short-term outlook for the global economy”.

Given my conservative nature when it comes to resource companies and the numerous unknowns you have to factor in, I would be inclined to be more conservative with my assumptions when undertaking valuations for resource companies. If you take on blind faith a A$22b profit, BHP’s shares are worth AUD $45-$50 each.

But before you take this number as a given, note the red circle in the above chart. Earnings per share growth rates are already in the process of being revised down. I would expect further revisions to come. And if my ‘friends-in-high-places’ are right, it’s not out of the realm of possibilities to see iron ore prices fall 50 per cent in short order. You be the judge as to how conservative you make your assumptions.

A far simpler business to analyse is Woolworths and for a detailed analysis see my ValueLine column in tonight’s Eureka Report. WOW reported another great result with a return on shareholders’ funds of 28% (NPAT of just over $2.0b) only slightly down from 29% ($1.8b) last year. This was achieved on an additional $760m in shareholders’ funds or a return on incremental capital of 26% – and that’s just the first years use of those funds. This is an amazing business given its size.

My intrinsic value rose six per cent from $23.71 in 2009 to $25.07 in 2010. Add the dividend per share of $1.15 and shareholders experienced a respectable total return.

Without the benefit of the $700 million buyback earnings are forecast by the company to rise 8-11 per cent. However, the buyback will increase earnings per share and return on equity, but decrease equity. The net effect is a solid rise in intrinsic value. Instead of circa $26 for 2011, the intrinsic value rises to more than $28.

But it’s not the price of the buyback that I will focus on as that will have no effect on the return on equity and a smaller-than-you-think effect on intrinsic value (thanks to the fact that only around 26 million shares will be repurchased and cancelled). What I am interested in is how the buyback will be funded. You see WOW now need to find an additional $700m to undertake this capital management initiative. So where will the proceeds come from? That sort of money isn’t just lying around. The cash flow statement is our friend here.

In 2010 Operating Cash Flow was $2,759.9 of which $1,817.7m was spent on/invested in capital expenditure, resulting in around $900m or 45% of reported profits being free cash flow – a similar level to last year. A pretty impressive number in size, but a number that also highlights how capital intensive owning and running a supermarket chain can be.

From this $900m in surplus cash, management are free to go out and reinvest into other activities including acquisitions, paying dividends, buybacks and the like. So if dividends are maintained at $1.1-$1.2b (net after taking into account the DRP), that means the business does not have enough internally generated funds to undertake the buyback. They are already about $200-$300m short with their current activities. In 2010 WOW had to borrow $500m to make acquisitions, pay dividends and fund the current buyback.

Source: WOW 2010 Annual Report

Clearly the buyback cannot be funded internally, so external sources of capital will be required. In the case of the recently announced buyback it appears the entire $700m buyback will need to be financed via long-term debt issued into both domestic and international debt capital markets, which management have stated will occur in the coming months. They also have a bank balance of $713m, but this has not been earmarked for this purpose.

Currently WOW has a net debt-equity ratio of 37.4 per cent so assuming the buyback is fully funded with external debt, the 2011 full year might see total net gearing rise to $4.250b on equity of $8,170b = 52 per cent.

A debt-funded buyback will be even more positive for intrinsic value than I have already stated, but of course the risk is increased.

While 52 per cent is not an exuberant level of financial leverage given the quality of the business’s cash flows, I do wonder why Mr Luscombe and Co don’t suspend the dividend to fund the buyback rather than leverage up the company with more debt? This is particularly true if they believe the market is underpricing their shares.

Yes, it’s a radical departure from standard form.

I will leave you with that question and I will be back later in the week with a new list of A1 and A2 businesses. Look out for Part Three.

Posted by Roger Montgomery, 31 August 2010.

Thank.you for your book I have just received 3 copies for my son in laws -so clearly i was impressed.I had just estimated roe and intrinsic on several companies when i reread chapter 11 I am not clear why the numerator for roe can be either NPAT or operating cash flows–thay can of course be very different figures and give very different results-

Hi Bill Kernot,

The more important thing is to be consistent and conservative. Expect a much smaller universe when you use cash flow.

Roger,

Now WOW are out with a billion dollar property sale and leaseback proposal.

It seems the Board figured out that effectively funding the share buyback with borrowings is less than optimum…..so on to the next piece of financial engineering. The emphasis on the latter is a departure from past practice.For me, it sets a few bells ringing in the context of a business that has until recently focused on operational excellence as its core strategy.

Any views?

Regards

Lloyd

Hi Lloyd,

I thought I did comment on this one. What you want is fantastic operational execution as well as excellence in capital allocation. Perhaps the two are always going on, but the media is tending to focus on the latest bit of news that makes it appear its a company focus rather than just a normal part of the latter process.

Roger

In regards to your 2011F for WOW’s intrinsic value which rises from circa $26 to more than $28 due to the decrease in the number of shares by circa 27million shares – from the buyback.

Based on my inputs/assumptions which will be different to yours I arrive at a 2011F intrinsic value of $26.45…see below

Could you perhaps demonstrate the maths & rationale behind your upwards increase using either WOW (preferable) as an example or fictitious numbers??

Prev Years Equity $7,570.40

Share Buyback $ 700.00

Equity Post-Buyback $6,870.40

Forecast Earnings $2,182.46

Forecast Dividends $1,527.72

New Share Capital $150.00

Forecast number of shares 1,211.50

Prev Years Equity per Share $6.11

Forecast EPS $1.80

Forecast DPS $1.26

New Share Capital per share $0.12

Buybacks per share $0.58

Equity per Share $6.20

Earnings Payout Ratio 70.00%

Forecast ROE 31.77%

ROE Selected 30.00%

Investors Required Rate of After -Tax Return 10.00%

0% Earnings Retention Multiple 3.000

0% Earnings Retention Value $13.02

100% Earnings Retention Multiple 7.225

100% Earnings Retention Value $13.44

Intrinsic Value $26.45

Hi Matt,

You will have to give me some time, to check your numbers and isolate the differences. Of course it goes without saying that a debt funded purchase have an even greater impact.

Roger,

Now we have WOW doing a sale and leaseback of $900 million of property.

it seems like the CEO and Board are currently more focused on financial engineering than operations management?

Or did they wake up to the fact that the share buy back was being funded by debt and so are looking for alternatives?

Regards

Lloyd

Hi Lloyd,

…or perhaps the media is focusing on these things for now. The best rowers do operations and capital allocation well.

Thanks everyone for their help, I guess the main point was using 10% RR instead of 14%, when I look at Net Profit excluding abnormals it has been consistent since 2005.

I understand the concern with China, iron ore prices, Potash etc so that’s the dilemma on working out any companies IV what return to use.

I guess I’ll get better at it over time, hopefully!

Cheers!

Hi Roger….

I thoroughly enjoy reading your blog as well as all of your reader’s comments and, with that in mind, may I suggest you start a forum linked to your site(s)??

I’m sure many of your readers would participate and could be a great way for like-minded individuals to “compare notes”…

Keep up the fantastic work.

Nigel.

Thanks for the suggestion Nigel.

Hi Roger,

Value.able has turned my investment world upside down and not before time. If only you could have written it 20 years ago, before I started my investment journey! And now after viewing some of your television appearances, I discover that in addition to being a tremendous intellect, you also have some real moral fibre (not intrested in buying metal storm because they make weapons). Why can’t we have people like you running the country rather than the hacks we have to contend with? Can’t wait to read your second book.

Kind Regards,

Martin.

Hi Martin,

You aren’t the first person who has asked, but I think I can add more value doing what I love.

Some quick thoughts on MCE, which seems to be flavour of the month as I read through the recent comments.

Probably belongs on an earlier post – but fits in with the cyclical considerations that are also appropriate to BHP.

I get return on funds employed for MCE of 11.5%, 14.5% and 36.6% over the last 3 years.

In the year just gone, Profit margin has exploded while asset utilization has fallen.

Operating cash flow plus PPE was Negative 15 Million last year.

The company has increased its credit facilities from 3.5 to 39 Million to fund the remainder of the Henderson Development.

My reaction to the numbers is that I’m looking at a capital intensive business with high operating leverage. Margin explosions like this are typical in industries where capital investment is withheld because the whole of cycle return doesn’t justify the investment.

MCE is now investing capital for future growth – yet the owners have diluted themselves twice to fund that expansion – why hasn’t the business generated enough capital in the past to fund this expansion internally?

Why have the owners now sold down? Do they understand the industry cycle better than those they are selling too?

Perhaps I could be convinced that MCE is a cheap cyclical with the potential for upside speculation in the near term (based on forecasts and continuation of current macro picture). But an A1 that will generate good cash flows for many years into the future????

If history is any guide than somewhere in the future Oil price wil take a big breather and MCE will have a large asset base and very little revenue and that won’t do ROE much good at all.. what goes up quickly normally comes down even faster. I hope they are debt free at that stage. If the macro works out in MCE’s favour than I will look like an idiot for watching this one leave the station, but it won’t be the first (or last) time. Good luck to those who do choose to get on board.

Hi Gavin,

The great thing about the market is that it allows us to all have different views and remain friends! As I have said, MCE most certainly has its revenues exposed to “macro” risks. And yes, as I mentioned on air, the $15 million negative cash flow is correct BUT thats after massive PPE investing that you also mention. You have left out the order book – although we aren’t privy to all the terms of the contracts. The business has been operating since 1982 and it appears to have been more recently that the family hit on the technology through R&D and good fortune that has resulted in a very large increase in work flow. There are indeed risks and so a big part of investing involves knowing how much of the portfolio to invest in any opportunity. This is not something to put a quarter of the portfolio into.

Hi again Gavin,

What asset utilisation ratios do you want to discuss?

Roger

I fear that my wish for good luck may have been taken as sarcasm. Whilst I will not be investing in MCE I do see merit in the company. I suspect I see the investment proposition as more high risk than perhaps some others may do, but I can also see the potential rewards.

I didn’t mention the order book for the next couple of years, but I am aware of it and it is obviously what underlies the forward forecasts. The thing is, it’s not the next couple of years that interest me, it’s the next couple of decades.

MCE does not fill all I want for an investment and I put in the post some of the issues that remove it from my universe and cause me doubts. I have no objection to differing views or hearing my points countered by other people’s analysis and research. I sincerely hope that anybody that does choose to invest in MCE does well with it. My post was not meant to suggest that they won’t, I was just raising some of the issues that I considered when looking at it and that hadn’t been canvassed in other posts.

The asset utilisation I refer to is sales/total assets.

Hi Gavin,

Thank you for the clarification. I hope you don’t mind if I open up our conversation so everyone else can get a handle on what we are talking about. Operating leverage is something I do think about. Whenever you see the word leverage you should think that when times are good, you will make a lot of money but woe be to you if the sales don’t come through. It is the same with financial leverage. Many analysts jump on companies when they see sales up 5% and profits up 20%. Operating leverage is simply a function of the proportion of fixed to variable costs. Its unfortunate that we really cannot get an accurate picture of operating leverage however because as share investors we aren’t privy to the character of all the expenses. We can of course get a pretty good idea. MCE, Decmil and FGE have a high proportion of fixed costs and so high operating leverage (to varying degrees of course). These companies tend to drop a high margin of sales to the bottom line once the fixed costs are covered. Woolies and Coles however have a much higher proportion of variable costs and lower operating leverage. As revenue rises so do the variable costs and the net profit margin doesn’t change all that much.

Roger

A very nice description of operating leverage.

Onto another topic.

You mention Decmil and I was wondering how you treat the 7 million goodwill they wrote off this year, when calculating ROE? In DCG case the magnitude of difference to ROE is not great but it’s a good example of something to watch for, because the effect can sometimes be very material. This periodic cleansing seems to be way too prevalent for many companies (BHP is a classic for it; Fosters would be a good large cap example this year.)

Decmil example:

Closing Equity as reported = 89.8 Million

Shares on Issue = 123.6 Million

Forecast EPS 19 CPS or 23.48 Million

Forecast ROE 26.2%

Closing Equity if Impairment wasn’t taken = 96.8 Million

Forecast ROE 24.3%

There’s no need to adjust the closing equity figure to account for impairments of assets (including). Once its written-off its gone.

I will do a post on abnormal items soon to help everyone out.

Hi Roger and everyone, I thought I’d seek the guidance of others practicing valuing and maybe Roger can give some guidance too. I have valued WTF Wotif due to it being sold off recently 10%rr, 60%ROE payout of 85% and got

2008 Book Value 0.269 = IV $2.11

2009 BV 0.342 = IV $3.06

2010 BV 0.410 = IV $3.56

What I am still struggling with is working out valuations for 2011, 2012 and 2013. My understanding is to use the EPS minus DPS to get the earnings per share growth and then add that to the previous book value. But that dosent seem to work when you back test it on previous years (i know its just a guide or educated guessing). On forecasts of

2011 EPS 28.6 – DPS 23.3 = 5.3 cents earnings per share

2012 EPS 31.9 – DPS 26.6 = 5.3 cents earnings per share

2013 EPS 34.7 – DPS 29.5 = 5.2 eps

So as I think it works 2010 book value of 41c and 5.3 of growth would give 2011 book value of 46.3 or 0.463 and so on. Is this correct or am I off somewhere. Thanks for any help anyone can provide, I want to get this right to finish off all the stocks I am valuing. Please King Roger help, (am loving valuing by the way)

Hi Patrick,

Historically you have the benefit of all the facts including capital raisings and changes to “reserves”. By only adding profits and subtracting dividends historically, you are leaving those out and thats why they aren’t reconciling. When a company announces a capital raising I always update the equity even before the half year or full year results are in and I do this for every single listed company! To short cut the process, I get a valuation of $4.64 (2011), $5.42 (2012) and $6.29 (2013).

Thanks Roger, that makes me quite a long way from your valuations but I will keep trying/valuing

Hi Roger,

How much does yesterdays announcement about pokies restrictions affect Woolies future earnings for their hotels divisions? What about ‘mad’ Bob Katter’s demands for the breakup of Coles/Woolies and other concessions for farmers, etc. that may put up a small amount of political risk around Woolies? I’d think that their is a little bit of uncertainty around Woolies at the moment due to political reasons – who knows what they’ll give up next for power!

Regards,

Ross.

Hi Ross,

Political/legislative risk is something that needs to be considered and does increase the investment risk case. You raise a point that is worth thinking about but one which remains speculative until we find out who will lead and on what terms.

Hi Roger,

After reading this post and many of the reader comments I thought I’d share one of the main lessons I’ve taken from reading your book. And that is investing only in businesses I understand. Take BHP for instance. Sure I can run the numbers and come up with an IV, but my lack of understanding of the business still leaves me with some doubts. Together, commodity prices, currencies, political decisions, reliance on certain markets, etc, are all things I don’t believe I fully understand. Now look at a business like WOW. I can walk into dozens of outlets they own, I know people who work there, I’m a customer, etc. So for me, I’ll be mainly concentrating on tracking those businesses I believe I understand and waiting for them to trade at my required margin to IV. And the less I understand the business the greater the required margin will be.

Regards,

Craig.

Craig,

Amazing insight and terrific advice. Moreover, BHP is a commodity business with a bunch of variables that drive profits, that the company cannot control. Witness the circa 20 per cent fall in iron ore prices…

That struck me too Craig. In trying to value companies that are changing rapidly or that I can’t get my head around, I have been producing ‘valuations’ that I am not inclined to trust given the potential effect of big changes in the key variables. This makes me shy away from companies that I might have previously regarded as ‘good’, and would have bought if they fell a bit below their recent trading range.

There were several other points from the book that hit me between the eyes, including something to the effect of ‘it’s better to be approximately right rather than precisely wrong’ – ie, if you use a RR of 10% instead of 11% or assume a different payout ratio and get a valuation of 3.20 rather than 3.00, it doesn’t matter that much since you want to buy it at 2.10 anyway. Hence why Warren and Charlie might come up with different valuations but the same conclusion.

This stuff might well just be common sense but sometimes it’s not until it gets clearly articulated that it becomes obvious. This is something that I do every day in my profession (from the opposite side, mind you) and I’m a bit disppointed that I was too dim to twig with a few points before they were pointed out in the book.

Hi Roger

thanks for the book. The art of deciding an appropriate RR obviously makes a huge difference and presumably comes with experience. DWS is a good example: my intrinsic value is around $1.40 using an RR of 12%. I chose 12 because its small and doesn’t seem to have a long track record. By comparison if I apply 10% its appears to be fully valued leaving aside 2011 and 2012 growth forecasts. But I wouldn’t be comfortable with that.

My kids are into the share market and we are working through your book together, its a great and relatively easy to follow resource.

Hi Ron,

I am delighted that you are sharing my book with your children! How old are they? Your story might inspire others to do the same.

Hi Roger

Have recently bought your book, interesting reading. In regards to BHP I have calculated the intrinsic value at $41.67 this was done with $10.11 EPS, payout ratio 40%, ROE selected 25% and 10% required return. What have I done wrong. I own a lot of BHP shares and now I’m not sure wether to keep them or not!

Hi Deb,

I am not sure. Are you using USD or Australian dollar numbers?

Using figures supplied on Commsec.

OK Deb. How about you post all of your inputs here. I suspect there are a bunch of people who’d be more than happy to find the source of the discrepancy.

Okay here goes

Equity 56,934 /5630 = $10.11 eqps

Payout ratio 40%

Net profit 14629/49240 beg equity = 29% ROE

Selected ROE 25% required return 10%

Table 1 10.11 x 2.5 x 40% = $10.11

Table 2 10.11 x 5.203 x 60% = $31.56

Add them together I get $41.67

Can somebody assist!

C’mon all, Give Deb a hand with her valuation calc.

Hi Deb,

I’ve used the following numbers to come up with an IV of $28.93

Total Equity – $56.055,681,000

No of Shares – 5,564,400,000

Equity per share – $10.07

NPAT – $14,782,666,000

Beginning Equity – $54,281,333,000

ROE – 27.23%

Dividends – $5,247,727,000

Payout ratio – 35.50%

IRR – 14%

Exchange rate – $0.88c

Hope this is of some use.

Excellent Peter. Thank you for taking the time to help Deb out.

Deb,

What is your required return from a business where profitability (and thus ROE) can swing 50% year over year based on commodity price fluctuations?

I would be looking for much more than 10%, notwithstanding the much touted diversification of BHP across a number of commodities.

Regards

Lloyd

Indeed Lloyd.

Yeah strangely I derive a 42 dollar for BHP for

2010, and I actually thought that was correct given the stock price has deviated around 37-44.

Eamon

Deb,

I suggest the following;

1. Use the figures from the company report. (shares on issue would then be 5565, not 5630)

2. Add last year’s equity to this year’s equity and divide by two. Use that as your equity figure.

3. Consider whether RR of 10% is sufficient to allow for the risks associated with mining companies – if you use 14% instead, you will get an answer much closer to Roger’s.

4. If you use all the figures from the company report, just divide by 0.87 as a reasonable conversion rate to Australian dollars. (That appears to be what Commsec are using)

Thanks Ken. I am sure Deb will appreciate the suggestions you have taken the time to share.

Hi Roger

I am using 50.168bln in equity, 17.5% ROE, 37.6% POR and 3.356bln shares on issue.

I get an IV of $35.90.

Not the easiest company to value though and looking at the IV for next year it’s quite a lot higher on consensus data but who believes that?

Thanks Craig. Yes the valuation is dependent on ROE, which in turn is dependent on commodity prices. Iron Ore could halve and that would see analysts scrambling to recalculate estimates lower.

Deb,

I can arrive at a similar answer to you if I use 25% ROE and 10% RR, but in fact the ROE is 28.27% (call it 27.5%) and I use 14% RR for all materials and energy companies due to the higher risk factors. Another trap when using the Commsec figures is that if you multiply the dividend cents per share by the number of shares, you will rarely get the same answer as the financial reports show. This is because the dividend cents per share shown on the Commsec tables represents the dividends declared for the year, but because the final dividend is almost always paid after the financial year, it is accounted for in the next year’s figures. If you have access to Commsec, you have access to the company reports (Appendix 4E) and that is, I would suggest, the best source of information.In the case of BHP the figures on its reports are in US$, but that doesn’t matter, and you can easily convert your IV to AU$ when you finish.

Hi Deb,

Ken’s right. As I mentioned earlier, the DPS figure used by the company has ‘shares on issue as an input’ and it is unlikley they used the number of shares on issue at the end or the begnning. You would have to solve for it. Ken’s also got it right for the conversion to $A for BHP.

Hi Roger

Last week on Your Money, Your Call on Sky, I thought you stated that share prices for BHP, RIO & FMG were below intrinsic value. My impression from this blog entry is that for BHP this is not the case.

I’d appreciate your comments

Hi Jim,

I updated the valuations right after the show. Keep in mind everyone that valuations change when companies are reviewed. Remember I am under no obligation here to keep things up to date, review results in a timely manner or do anything else that you might want to rely on in your investing. Thats why I keep saying seek and take personal professional advice.

Hi Roger,

What do you (and anyone else who may like to comment) think is REX competitive advantage?

Cheers

Brad

Hi Brad,

Monopoly routes would be my suggestion. I understand Virgin have just pulled out of a bunch of regional routes too.

Hi Roger,

Read a story in New Scientist magazine about the move toward drilling for oil in ever more difficult locations i.e. in water of the Arctic circle. Just thought it ties in well with the tapestry of information surrounding MCE. Story located here: http://bit.ly/bZLwre These links only last a week or so as they are a promotion run by the mag on Twitter. This story has the usual environmental perspective about it, but none the less, still illustrative.

Great stuff Robert,

Thanks for sharing.

Hi Roger,

Apologies for going off topic. When calculating IV, if the payout ratio is greater than 100%, then for the purposes of the step 4 calculations, should one use a figure of 100%?

Regards,

Craig.

Thats right Craig. Well done. 100%. Thats the only practical solution.

Hi Craig,

Just a tip with a more than 100% payout ratio – If your doing the next years valuation as well make sure you reduce your equity per share as this will reduce.

Correct Ashely, good appendum.

Interesting perspective on BHP Roger, I appreciate your learned insights. Looking at yout modest IV calculation, I take it that you’ve slapped on a 14% RRR – is this to reflect the avaricious forecasts being made as you refer to, or merely the necessity to receive adequate compensation for investing in such a cyclical industry?

Hi paul,

I doubt very much that the discount rate is 14 per cent. I have to go back and check and will report back this afternoon.

Buyer beware of BHP and RIO long term these company are anything but A1 IMHO B1 is the best that they can shoot for unless they diversify there holdings. The China story is the ultimate bubble! Building empty office spaces for a population that neither will use or need outside their major cities is an example of forced productivity. China needs the U.S economy to boom for an extended bull market to occur for the need of such a large appetite of iron ore. BHP has seen the writing on the wall (Potash bid) and is desperately trying to buy businesses outside its stable to compensate for when the China Bull in the china shop starts to crash.

Hi Simon,

Thanks for your thoughts. Did you see that BHP is rated B1? Thanks again for taking the time to post your thoughts and sharing your views on China. I am similarly concerned but don’t have the crystal ball of the economists to be sure.

Economist gets it wrong too, we are human irrational beings.

Dear Roger,

re MMS, thank you for your message that you’ll be in contact. I’m keen to meet to discuss your views on ILA. I’d be pleased to go through our detailed balance sheet and cash flow models with you to highlight both the level of gearing (d/ d+e) in the business and the ROE. I also feel the risk profile is better than what you might expect seeing ILA is self funding and the packaging cash flows are ringfenced. I understand the banks are keen to support the business rather than “control” it as you suggest. I look forward to meeting you at your convenience. Regards, Michael Brown

Thanks Michael,

Will do . How’s next week for you? I look forward to chatting.

Hi Roger,

Thanks for the good work during a busy reporting season. I am interested in the detail behind your valuation of BHP at $26 to $30. I worked it through at $41. I’m guessing that you are factoring in a future decline in roe? Am I on the right track here?

Much appreciated.

Hi Tony,

Have you backed out the abnormals? Are you also using the correct currency?

Hi Roger,

Thanks for the write-up.

As a WOW shareholder, I did find it alittle strange that they are funding the buyback through debt. It seems Mr. Luscombe wanted to get in the shareholders “good books”.

So Roger, are you saying that you would rather WOW didn’t carry out the buyback if it is going to fund it with debt?

Personally, it doesn’t bother me all that much. Of course it would’ve been better if it was being funded out of internal funds, but with the size & cash flow of WOW, alittle more debt isn’t a huge problem.

Thanks again Roger.

Hi Shaun,

Its got the cash flow to pay down the debt relatively quickly but the share price is around its intrinsic value now. If you cannot find something else cheap to buy, buy yourself. I would be delighted to see the dividend cut and the cash used to pay for the buy back instead. But in Australia, capital is not always managed purely for the benefit of the company and the long term shareholders interests. Sometimes the short term income needs of retired investors comes first.

If I was management I would declare a share split 10 for 1. Than hope the price tanks from the higher price and through my buyback plan buy back the smaller quantity of shares at a discount to it’s value!

Hi Eamon,

Not sure that would work either. Care to expand?

Let’s say there 1000 shares listed trading at 10 dollars for the past few months very flat performance. I would then annouce to the market that we would do a 10 for 1 spit. Therby converting 1000 shares to 100 shares at a new price of 100 dollars. It may look the same as not spitting the shares at all, but what I’m hoping to result is if the market as a whole tanks like what we saw in the GFC, then perhaps our shares would also halve. This way my share buyback scheme would be able to buy back the smaller quantity remaining at an attractive price. My predictions is the higher the price a share cost the greater it’s movements would be in a bear market. The reverse would be true for cheap stocks in a bull market. I guess it’s that han perception, in believe 1 dollar cheaper than 10 dollars than to 100 dollars. So given the high prices demanded from my stock there might

be less enthusiam for them in a bear market. Hence presenting an opportunity to buyback.

Hope that makes sense….

Eamon

Ah Eamon,

The confusion I had came from your labelling this a ‘split’. Is a share consolidation not a split. The outlay under the scenario however would be the same whether the shares were consolidated or not.

Oh really, it wasn’t to my knowledge that it’s call consolidation not a split, I do appologize for any confusion.

Eamon :-)

WOW should not have a buy back of that magnitude at a time when there is little economic certainty, I presume they will not be exposed to a hike in interest rates. if the directors could read your book they would understand the effect debt has on results. Don’t we want a company with high ROE, low payout ratio and LOW DEBT. At least it is in industry where we have an extra 400,000 mouths to feed each year and it’s opposition WES( Coles) is straddled with debt and has a ROE of 6.34. The WOW moat appears to be ok.The buyback should be 350M this year and repeated again next year if conditions are favourable. Roger, you have my vote for a WOW board position.

You are very kind Brian. I think the combination of strong cash flows plus sensible capital management would be very powerful but there would be a short term cost that people couldn’t stomach.

I have recently sold out of MMS, BHP and WOW and taken good profits on all three. Reading your last two blogs has reinforced my decision. All three are good companies and are most likely to still perform well. However, following the principles in Value.Able I hope to do even better(and with less risk) with my business choices.

Thanks for sharing your thoughts Stuart. Just be sure to seek and take personal professional advice.

We need to eat Roger! That’s the usual mentality of an ordinary share holders.

Thematic but simplistic. You are right Eamon.

I remembered writting a letter to a company that returned very high ROE. I asked them why they didn’t retain the earnings to compound the business. They responsed by saying “our company has a board range of clientiles, inclusive of dividend dependent investors. Hence to statify this group of clientile the company must continue providing dividend.”

Eamon

Hi Eamon,

Thats exactly the kind of compromise that prevents much higher returns for investors and shareholder/owners.

Maybe that’s why the CEO of Myers came out and said he prefered Myers to be privately held, instead of re-listing onto the market. He argue that when Myers was privately held he only needed to report back to one owner once in a while. Hence allowing him to focus on his job, not like now where he must report to many owners. Reminescence to dividend policy, one owner one decision, life would be much easier.

I saw the same comments Eamon. I know a few former public company CEOs who wouldn’t go back to it.

Hi Roger

It is a great position for WOW to be in. My reading of the above is that you’ve assumed 100% of capex should be equity funded. I would have thought some of it, maybe 37% (current gearing level) of the $1.8b of capex, could be assumed it be debt funded, thereby providing sufficient internal funds for the buy-back. I know this is just a different way of cutting the same cake, but I think it a reasonably efficient way for WOW to manage thier capital whilst still providing the dividends and distributing the associated franking credits.

Hi Greg,

Not making any assumptions. Interestingly, the intrinsic value rises either way.

Hi roger I must admit that when I first saw the WOW buyback my first reaction was – Good boys. It was only later that the increased debt made me feel a little less comfortable.

As a WOW shareholder I would be delighted to see the dividend suspended to fund the buyback. The sharepirce would totally tank giving us a chance to buy more.

Hi Ashley,

We’re singing from the same hymn book. Trying to be all things to all people usually satisfies nobody.

Also PTM I have got a price under $ 3 ……..excuse the grammer on the last message……….see ya

I argee fully Roger.

Management should explained to shareholders the value of a flexible dividend policy. A buy back is better for share holders this year but debt repaymeny or a special dividend is better next year. We should always do what is best for the owners.

Same with BHP, why pay an increased dividend and at the sametime borrow to acquire $44B Potash Co. Why not suspend dividends now and pay heaps more divs later.

I’m not retired so do not need the income stream. I understand many shareholders do want & need the regular income. Growth Income & Risk.

Life is always a balancing act.

Hi Greg,

You are right. The revolving door of cash also costs more for the company in frictional charges. Even if you are requiring income, you can find wonderful businesses to buy but it may be asking too much to say that once a company’s shares are bought by someone for income that the company is beholden to that expectation.

My valuation is under 30 for bhp and under 20 for wow, I never go broke. I remember people talking about bhp going down to $12.00 during the GFC so you never know..see Roger……….

Thanks for sharing your thoughts Fred. Really appreciate you taking the time to write.